Pololu Blog » Engage Your Brain »

Coronavirus impact update: still shipping all orders

Quick summary: Pololu has filled all orders and continues to operate, including shipping products to important customers fighting COVID-19 around the world. Thank you for all of your help and donations, which are really making a difference. We are preparing for extended operations under emergency conditions and evaluating all available avenues for support. Cash donations remain the most useful and immediate way to help, but there are other ways you can help us. Donate here.

Please see new update posted Monday, 6 April 2020.

|

Still shipping, 30 March 2020. |

|---|

It has been a week since I posted about Pololu’s dire circumstances brought about by the new coronavirus pandemic. My outlook today is much more positive than it was back then, in large part thanks to the support we have received during the past week. We are by no means out of the woods yet, as a company, as a country, and as a planet. I write today’s post to provide an update on how we are doing, to try to address the questions I am getting repeated from many people, to share our general outlook for moving forward, and to renew my appeal for help in any way possible. Since there are many topics that might be of varying degrees of interest to each of you, I will try to organize this with more sections and headings:

- We are still operating, with every order shipped!

- Thank you to everyone who has donated

- Updates about common questions

- Outlook and plan for now

- How you can help

We are still operating and have shipped every order!

We have operated for eight business days now with a skeleton crew of approximately 20 staff members on site and 10-20 more people assisting via remote connections from home. We have shipped every order for in-stock items that has been placed during that time, and we have limited production capacity for special orders beyond what is in stock.

We have had no new local business shutdown orders that would affect us since Friday the 20th, and we have received dozens if not hundreds of customer requests and certifications from customers that have been declared essential businesses or services within their jurisdictions, and as suppliers to those organizations, we are essential by extension as well. We also continue to get many confirmations of our products and services (e.g. laser cutting) being used directly in the response to the COVID-19 pandemic, so we will keep shipping orders as long as delivery services keep operating.

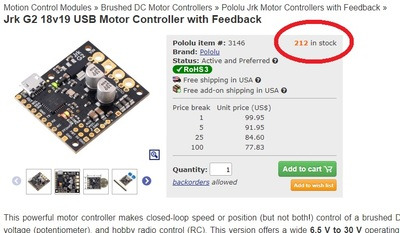

You can see available stock for each product live on our website, and if your order consists of just in-stock items, we should be able to ship your order within a day.

|

Available stock is shown on each product page. |

|---|

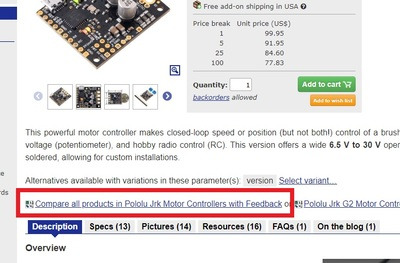

Each product page has links to relevant parametric comparison tables that can help you identify similar products that might have more available stock:

|

Each product page has links to relevant parametric comparison tables. |

|---|

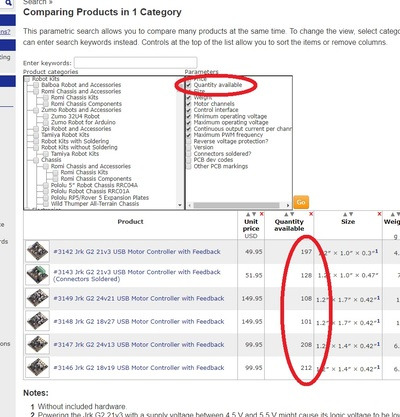

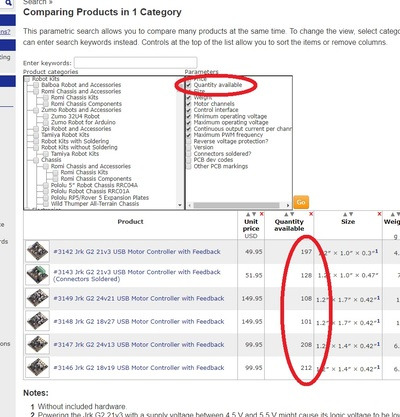

|

You can check available quantity of similar products on the parametric comparison table. |

|---|

Our China facility in Shenzhen is also partially operational, and we are able to ship some special volume orders directly from there. The available shipping carriers and destinations are changing day by day as countries respond to the pandemic, but we are working with customers to route critical orders as quickly as possible. Please note that all of our electronics products are manufactured at our Las Vegas, Nevada, USA facility, so shipments directly from China are only available for select products, mostly motors and other mechanical components that we have machined or injection molded there.

We also have hundreds of distributors around the world that might be operational and have stock closer to you. We will be working with them in the coming days to update the distributors page with information about those businesses confirmed to still be in operation.

Thank you to everyone who has donated!

We have received thousands of dollars in donations since my original post. I have tried to send at least a few personal thank you emails every day, but there have been more donations than I can keep up with. It is extremely motivating to see the breadth of donations we are receiving from all over the world, from customers we haven’t heard from in a long time, to family members of employees, to former employees, to people that, as far as we can tell, have had no previous association with Pololu. To all of you whom I have not thanked yet individually, thank you!!! I am making sure everyone at Pololu knows about your support. The value of the money we receive in donations is multiplied both by the psychological boost it gives us and by getting factored into various lines of credit that we have available to us that are automatically calculated based on the rolling average revenue appearing in our accounts.

Several Pololu employees who are part of our continuing operations have volunteered reductions in their own pay so that we might conserve our limited cash on hand and continue payments and insurance for those employees that are most in need. PT from Adafruit also responded to my call for help and gave me some useful perspective and helped spread the word about our situation even as Adafruit conducted its own emergency operations out of New York, the US epicenter of the coronavirus outbreak.

The donations and support are all the more meaningful at a time like this, where nearly everyone is impacted and the future so uncertain.

If you can, please consider donating to help Pololu make it through this difficult time. You can use item 2400 to donate in $1 increments. I will also post other ways you can help us at the end of this update.

Updates about common questions

Landlord and building situation

After payroll, the building rent is our biggest expense and obligation, so I of course reached out to my landlord right away to see what their position was. Unfortunately, the building we are in was just sold in the last 6 months, so we do not have the long working history we had with the previous landlord. I am posting a little more detail here than I would normally be comfortable with, but we are in an extraordinary emergency and I am hearing the same questions and suggestions from multiple people, so I want to share this information because I believe it could be useful in getting us help and advice.

|

We are the only tenant in a building that is approximately 86,000 square feet. The building had been vacant, I think for years, after the previous economic downturn, and we moved in here at the end of 2011, taking part of the first floor. In 2013, the landlord received an offer for the second floor. It was a time when we were growing rapidly, and the building was not at all well set up for sharing with multiple tenants, so we made the owner an offer for the space and reached an agreement that was expensive but affordable for us and at a lower rate for the landlord than the competing offer but without the need to do any new construction. Over the next several years, we agreed to extensions in the lease and a gradual takeover of the remainder of the first floor, so that we would officially have the building to ourselves and the landlord could stop looking for other tenants to fill the remaining space.

In 2018, we negotiated a new extension of the lease. The building was still in its as-is state from 2009 or whenever the previous tenants moved out, and it was a particularly impractical floorplan based on the previous tenant’s operations. The landlord preferred putting some money into renovating the space and increasing our rent over keeping the rent at a bare minimum, and so even though our cost went up again, we were getting a more usable space with plenty of room for growth at still a decent total cost. The renovations took longer than expected and ran through most of 2019. Some kind of family change caused the landlord to unexpectedly have to sell the building, which got us to where we are today: with a new owner, in a building that is bigger than we need but well set up for us, and with what I think is a pretty good rate.

The new landlord thinks it’s an incredibly good rate and thinks the market rate (of course before this pandemic hit) should be closer to double what we are paying now. We have more than four more years left on our lease, and from his perspective, he might even prefer us to be out of the building. I suspect he has dozens or even more tenants from all over suddenly asking for reductions or notifying him that they won’t be able to make rent, and given his view of what we are paying relative to what the space is worth, we are going to be low on the list of tenants he wants to make special exceptions for. So for now, if we believe we can be back to full operation in the next few months and then resume the growth path we were on, it is very important for us not to give the landlord any pretext for evicting us. I realize some of what he told me might be for negotiation, but I believe he was generally up-front with me. (And I’ve been using the singular “owner” or “landlord” or “he” for the landlord in both the current and previous landlord cases, but really I am talking about my contacts for the ownership groups.)

I related the history of how we got here so that people who know more about this kind of thing might be able to give me better advice and so that people who look at some of the pictures I am posting don’t feel that we are wasting money on an extravagant work space. Yes, we could fit our current operations into a 50,000 square foot space. But building rent agreements can be quite long-term, and with the amount we have invested in equipment and improvements here, moving would be very expensive, even if we could find an appropriate space. And the value of our contract depends a lot on how things play out. If there is a long-term depression that we cannot survive, the contract is an anchor that will drag us down and potentially finish us. If things get better relatively quickly, the contract protects us and gives us stability, letting us operate at a relatively good rate, without having to interrupt everything to move.

I should also make sure it’s clear that I completely understand my landlord’s perspective (who of course has his own mortgages and employees to keep paying), and it’s good to know that he’s open to arrangements that could be mutually beneficial. Perhaps some more spaces will open up as other businesses close, and if we get forced to stop operating for an extended period of time, that interruption might also be a good time to move. For the time being, though, I think we just need to hang on for a few months, and if that is the case, we have to keep paying the full rent.

Stimulus bill and SBA disaster loan

After days of trying on the overloaded SBA disaster loan website, we got our loan application submitted at 2:30AM on Tuesday. It’s not clear how long it will be before there is some progress with that or how much assistance we would qualify for.

We are also paying attention to the new stimulus bill that was just passed to see how it might apply to us. So far, it looks like it will be at least a few more weeks before the details get worked out to a level that we can do something with. The initial impression I am getting is that the way the support is structured, we might be incentivized to do things that would be bad for us if the support doesn’t pan out. For example, it is paramount for us to cut back on expenditures so that we have some cash to pay the most critical bills as long as possible. That includes laying off non-essential staff right away. Yet that might reduce or even eliminate some of the support we might qualify for.

There’s also a huge difference between getting a loan and that loan being forgiven. If the model for our collective response to the pandemic is that the government orders us to pause operations, then gives me money to distribute to my employees, I am happy to do my part in that arrangement. If, on the other hand, the proposal amounts to me personally being on the hook for the rest of my life to pay back a loan I took just to pay people that weren’t allowed to work, that’s not actually helping, and it would make more sense for those employees to just get paid directly from the unemployment aspects of the support bill.

We might also be facing a situation where the new support measures might encourage people who could be working to stay home and collect unemployment instead. So far, we have gotten by without pushing anyone who does not want to be here to be here. This will be a challenge for society in general as we all try to pause and then recover in this unprecedented situation. Many individuals want to work, but it might be better for the community if they don’t, and in compensating them for preventing them from working, we might be discouraging other people whom we do need to be working.

Outlook and plan for now

The past two weeks of operation have made me optimistic that we could keep operating as we have for at least several more months. This past week was especially good because we had relative stability in how we operated, and it allowed us to spend a little time on getting ahead and start preparing for operating under these emergency measures for an extended period. A few engineers who had been working on production processes and were out the first week came in and started assessing our workflow with new distancing and isolation considerations. Having a lot of space is coming in handy, at least in terms of making it easier for people to work far apart from each other. We gathered in the same room once during the whole time, to select permanent spots in the break room:

|

Pololu skeleton crew permanent table assignment meeting, March 2020. |

|---|

(Those who have individual offices are encouraged to eat there, but in general, those are the people who are already home and connected remotely.)

We are also working on improving remote connection and working options where possible, including getting more computers and monitors to employees’ homes.

With the outlook unclear on how much government support we might get and when, it’s clear we need to transition to an operating mode where we can be largely self-sufficient financially without burning out before we get there. Here, the donations we have received have been tremendously helpful in buying us time to get back on our feet.

If you can, please consider donating to help Pololu make it. We have set up item 2400 for donating in $1 increments.

Other ways you can help

Pay now, ship later

In the past week, we added a feature to our online checkout system to allow for orders to be placed with a “pay now, ship later” option that lets you authorize us to charge the payment for an order as soon as it comes in, possibly well ahead of when the order would actually ship. We started working on this feature at a time when we thought complete shutdown of our operations was imminent, when it might have been weeks or even months before we could reopen. As I wrote at the top of this update, we have been able to ship all orders, and I expect to continue shipping, but this option still allows us to prioritize shipments and reduce stress with orders that come in later in the day and can get shipped the next day. We have already received dozens of orders with this option selected, and it is also encouraging just to see that our customers are trying to help us out. Thank you to all of you who have selected that option!

Order non-soldered versions of products, or the higher-stock versions

We offer a few of our products with some of the optional (but usually used) through-hole connectors soldered in. If you are able to solder, please consider ordering the non-soldered versions if there is plentiful stock of them. We do all of the through-hole soldering by hand, and most of our manual assemblers were older or otherwise in the higher-risk population for COVID-19, so they are not currently working here. And if you’re at home doing a non-critical project, now is a good time to do a little extra soldering, right?

On a related note, it’s a little bit easier for us if you order the item that has more stock. Going back to the screenshot I have at the beginning of this post, it’s easy to see our stock levels of similar products:

|

You can check available quantity of similar products on the parametric comparison table. |

|---|

If your application could get by with either an item of which we have 300 in stock or one of which we have 12 units, please get the product that we have much more of. It’s probably a more popular version that we make more often, and it keeps the less popular version available for those who might really need it.

Help each other on our forum

We have had to severely cut back on our technical support. If you are one those people with extra time on your hands now and are familiar with any of our products, please consider helping out our other customers on our forum.

Ask others to help us out

If you know anybody that could afford to help us out, please let them know and ask them to contribute.

Other suggestions and ideas

Part of the reason I went into more details in some areas is so you might be able to better give us advice about how we could make things better. Maybe you’re also working at a small business facing similar challenges, and you have some good suggestions. Maybe your uncle has a vacant building nearby. One suggestion I’ve heard repeatedly is about gift certificates, which we are looking into; if you know of particularly good ways of implementing that or things to be careful about, please let us know.

Thank you all for your support. Stay safe and healthy, everybody!

Please see new update posted Monday, 6 April 2020.

9 comments

They might help from a cash flow point of view, although it's a bit of a one time deal -- some future cash is brought into now, which seems good right now, but less good in the future. (Might still be the right choice)

Thanks for that advice. It's in line with other things I've heard that make gift certificates unattractive and why I've avoided offering them in the past. I also prefer to avoid the open-ended commitment, and my understanding is that Nevada's escheatment laws would make us owe most of the money to the state if we had an expiration date on the gift certificates.

- Jan

Thanks for your concern and suggestion. I am hoping that what we need (and what I am asking for) is relatively short-term help to get through the effects of all these shutdowns.

We are working on making sure we don't lose our building and our employees don't lose medical coverage and can get money to cover their basic bills. By maintaining operations, we are able to keep shipping products that we already know how to make to people all over the world who need them, both directly in this crisis and in other essential applications. Some of our engineers who are at home and are not dealing with immediate ramifications of the emergency state in their personal lives and Pololu's operations are looking at various projects to contribute to the fight against the coronavirus. But even if we could instantly be producing ventilators and face masks, that doesn't cover the employees who cannot come to work right now because they are in higher risk groups or have to take care of their kids that are not in school.

A "business model pivot" would be a longer-term consideration and more pressing if the disruption were more specific to our business rather than something affecting the whole global economy and which we hope the planet can recover from within a few months. If we knew now that the shutdowns were going to last for a year or more or if we had nothing else to do, then sure, it would make sense to think about completely changing the point of the business. If this current state became permanent, though, we're also talking about a world where most of Boeing and other huge companies full of smart engineers wouldn't need to exist, and all these Tesla and GM and MyPillow factories in the news retooling to make critical supplies would keep making them, so it's not clear we'd have some strategic advantage.

That said, if you know of existing products we have that are directly relevant to this current situation, by all means please let us know! Part of the (temporary, I hope) problem is even the supply chain you mention is broken globally right now, so we largely have to make do with what we already have in the building. Given that that is a limited resource, we definitely would like them going to the most valuable applications.

- Jan

https://www.npr.org/2020/03/20/818797729/how-buying-a-gift-card-can-help-a-small-business

Perhaps people would be more willing to buy a gift card than a straight donation but may not want to use the card for years until this mess is over.

- Kim

Dear Business Owners,

The Paycheck Protection Program is part of the CARES Act passed on March 27, 2020. The Paycheck Protection Program offers small businesses with 500 or fewer employees loans to pay up to 8 weeks of payroll costs (there is a $100,000 cap on annualized salaries for employees), related employee benefits, rent, mortgage interest and utilities (there are requirements that mortgage agreements, leases and utility services must have been in place before February 15, 2020).

This program offers loan forgiveness for employers who retain employees and/or quickly rehires them. Salary levels must be maintained. Loan forgiveness will be reduced if full-time head counts decline or if salaries and wages decrease. The Treasury Department has stated that likely due to the high demand for the program, there will be a requirement that 75% of the loan must be used for payroll to be forgiven.

For self-employed individuals and independent contractors, wages, commissions, income or net earnings are capped at $100,000 on an annualized basis.

In general, the amounts loaned will be based on your average monthly payroll based on the last year times 2.5 (or plus 25% of your average monthly payroll cost). The loan amount is subject to a $10 million cap. There is a different calculation for seasonal businesses or new businesses. Since these loans are based on payroll, it is critical you provide your lender with payroll documentation in your application. Please let us know if you need assistance with this information or calculation of your estimated loan amount.

The loans that are not forgiven will have a .5% fixed interest rate and loans will be due in 2 years. Loan repayments for any loans not forgiven will be deferred six months. Furthermore, there will be no personal guarantees or collateral requirements. These loans will be no-fee loans. The loan terms will be the same for all borrowers and lenders.

Small business and sole proprietors affected by the COVID-19 pandemic can apply for loans under the Federal Paycheck Protection Program beginning Friday, April 3, 2020. Then on April 10, 2020, independent contractors and self-employed individuals can apply for loans under the Paycheck Protection Program. The Treasury Department is encouraging businesses apply quickly due to the funding cap of the program.

Please find the application for the Payroll Protection Program application and supplemental information using the link below:

https://home.treasury.gov/system/files/136/Paycheck-Protection-Program-Application-3-30-2020-v3.pdf?j=268557&sfmc_sub=112293969&l=3151_HTML&u=8813279&mid=7306387&jb=479&utm_medium=email&SubscriberID=112293969&utm_source=NewsUp_A20Mar225&Site=aicpa&LinkID=8813279&utm_campaign=Newsupdate&cid=email:NewsUp_A20Mar225:Newsupdate:Paycheck+Protection+Program+application:aicpa&SendID=268557&utm_content=Special

The following link provides information on an overview, information for borrowers, information for lenders and the application for the Payroll Protection Program:

https://home.treasury.gov/policy-issues/top-priorities/cares-act/assistance-for-small-businesses

If you receive a loan under this program, you will not be eligible to claim the employee retention credit under the CARES Act.

Please contact your banker to ensure they are offering this loan. It is our understanding that almost all banks and credit unions will be offering these loans. According to the Treasury Department businesses “apply through any existing SBA 7(a) lender or through any federally insured depository institution, federally insured credit union, and Farm Credit System institution that is participating. Other regulated lenders will be available to make these loans once they are approved and enrolled in the program.”

Hope you get the help you need,

Tim

Thanks for sharing! This lines up with what our bank rep is telling us, and we're working with them to be ready to apply as soon as they start accepting applications. It's a little scary the way one loan might exclude you from another one, but it sounds like the banks and SBA will try to coordinate to maximize applicable loans without lending money twice for the same purpose. I hope it works out in practice! So far, it seems like everyone is working hard to make things better, which is nice.

I hope you and your business make it through, too!

- Jan

Somehow we will get red of this hard time

More info available at:

https://making.engr.wisc.edu/shield/